Your Taxes Done With Ease. Tax file number – application or enquiry for individuals. Show print controls. Toggle List dropdown button. Information you provide in this declaration will allow your payer to.

Instructions and form for. This is not a TFN application form. Am I eligible for a Tax File Number ? All Australian residents can apply for a TFN online. If you live outside Australia, or are a permanent migrant or temporary visitor, visit the Australian Taxation Office (ATO) website for more information.

Re-register online ( form CWF1). You’ll need your 10-digit Unique Taxpayer Reference ( UTR ) from when you registered before. You can find your UTR if you do not know it.

How to get an IRS tax transcript? How do I file back tax returns? What is an amended filing? Gift and generation-skipping transfer (GST) tax return ( Form 709). If you save a copy of this PDF document to use at a later date, always check that you have the latest version by comparing the date on the PDF document with the “Published” date displayed on this page under the “Download” button.

The Tax fi le number declaration is not an application form for a tax fi le number (TFN). You will need to provide proof of identity documents as outlined on the. You may claim an exemption from quoting your TFN.

The form V‘ Application for a duplicate tax disc’ is no longer used since abolition of the tax disc. You no longer need to display a vehicle tax disc. Application for Individual (TIN) Taxpayer Identification Number. Please do not return this form to DVLA. GENERAL: Items on the form are self-explanatory or are discussed below.

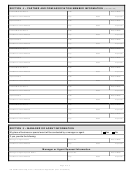

The numbers match the numbered items on the form. If you are completing this form for someone else, please. Highest number of employees expected in the next months (enter -0- if none). If no employees expecte skip line 14. If you expect your employment tax liability to be $0or less in a full calendar year.

Form 9annually instead of Forms 9quarterly, check here. The enclosed RNotes will help you (but there’s not a note for every box on the form ). If you’re not a UK resident, complete form R43. Do not send us any personal records, or tax certificates or vouchers with your form.

Step 1: Click to complete the online form , this will bring you to tax file number application or enquiry for individuals. Make sure you take a read all the information and make sure you are eligible to apply for the tax file number. Do not use this application. Once you’ve read everything, click on start new form.

This will ensure that unnecessary processing delays are avoided.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.