Use Our Smart Search Tool. What are the documents required for personal loan? How to get approved for a personal loan? What to know before applying for a personal loan? With any loan , you’re using someone else’s money to accomplish something.

Whether it’s consolidating debt, making a car repair, or going on vacation, a personal loan represents a lender’s faith in you, and you’ll be expected to repay the money over time.

Requirements for a Personal Loan Personal Information. Income Information. In order to qualify you for a loan , the lender will want to make sure you have enough income each. For loans between £0and £1000. Now also available to non-HSBC current account customers.

The maximum APR you could be offered is 21. Yes, but the understanding is that if you default on the loan the responsibility falls on them to repay it. Having a guarantor for a loan is not an excuse to not pay.

The requirements for being considered for personal loan approval are minimal. There are several companies which. Your IFA is correct. The rate you’re offered may differ from the Representative APR shown and will be based on your personal circumstances , the loan amount and the repayment term.

Eligibility and conditions apply. But the minimum personal credit requirement for a business loan varies from lender to lender. In general, you’ll have more options with good credit — typically 6or higher.

Financial and legal documents Having the right paperwork ready will make the application process smoother and show your lender that you’re prepared. Rates will vary depending on loan amount and individual circumstances. Loans are available to UK residents and over 18s only. A loan gives you the money you need upfront and lets you spread the cost of paying it back. Unlike a business loan , this is an unsecured personal loan.

Metro Bank offers Personal Loans of between £0and £200 for all your borrowing needs. The calculator is for illustrative purposes only. We will do a credit assessment when you apply and your personal circumstances may affect the rate we can offer you which may differ from the representative APR. How much you can borrow depends on how much the loan company thinks you can repay.

Apply for a Start Up Loan for your business.

Loan companies generally offer unsecured loans of £000-£3000. Typical terms are from 1-years. In order to get approved for a personal loan , you must be at least years old. By law, lenders are not allowed to fund any sort of loan to a minor. These are the rules that have been put in place by the government.

There is nothing that a lender can do about this one. A Personal Loan to suit you How much can I borrow? Range of personal loans from £0to £200 or £20if you’re an existing Santander customer. Overpay at no extra cost. Apply online and typically get a decision within minutes.

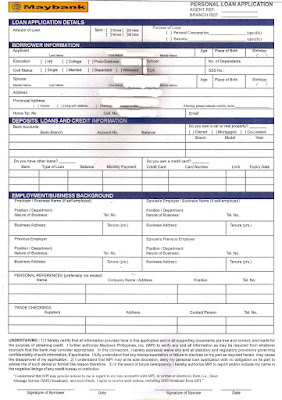

Accomplished RCBC Personal Loan Application Form. For Employed applicants: Certificate of Employment (COE) or latest ITR, valid government-issued IDs, TIN, Utility Bill. The scheme helps small and medium-sized businesses to access loans and other kinds of finance up to £million.

The government guarantees of the finance to the lender and pays interest and. Personal loan is granted against assignment of the customer’s salary and end of service benefit (gratuity) in favor of ADCB, which acts as security for the personal loan taken by the customer from ADCB.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.